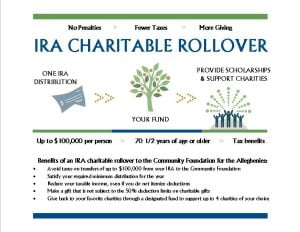

If you’re at least 70.5 years young, you can use your IRA account to support the causes you care about — without suffering the usual tax consequences of IRA withdrawal. This tax incentive is an opportunity to provide substantial funding to our region’s cultural, educational, and economic landscape.

If you’re at least 70.5 years young, you can use your IRA account to support the causes you care about — without suffering the usual tax consequences of IRA withdrawal. This tax incentive is an opportunity to provide substantial funding to our region’s cultural, educational, and economic landscape.

Thanks to decades of deliberate saving, some of today’s retirees have more money in their IRAs than they need for daily living expenses and long-term care. If you have it in your heart to empower your community through financial planning, think about collaborating with the CFA to have the greatest impact.

The Charitable IRA provision, first enacted in 2006, helps local nonprofits strengthen their communities by allowing individuals to transfer up to $100,000 a year from an Individual Retirement Account (IRA) to charity, without being federally taxed. The Community Foundation for the Alleghenies is a trusted vehicle you can use to address the issues you care about most, while gaining maximum tax benefit under state and federal law. We’ll collaborate with you and your financial advisor to make sure your funds are managed with integrity, in a way that’s meaningful to you.

The Charitable IRA provision, first enacted in 2006, helps local nonprofits strengthen their communities by allowing individuals to transfer up to $100,000 a year from an Individual Retirement Account (IRA) to charity, without being federally taxed. The Community Foundation for the Alleghenies is a trusted vehicle you can use to address the issues you care about most, while gaining maximum tax benefit under state and federal law. We’ll collaborate with you and your financial advisor to make sure your funds are managed with integrity, in a way that’s meaningful to you.

Reach out today, to Director of Donor Services Katrina Perkosky: kperkosky@cfalleghenies.org / (814) 208-8411. We’ll work together to realize your philanthropic goals.